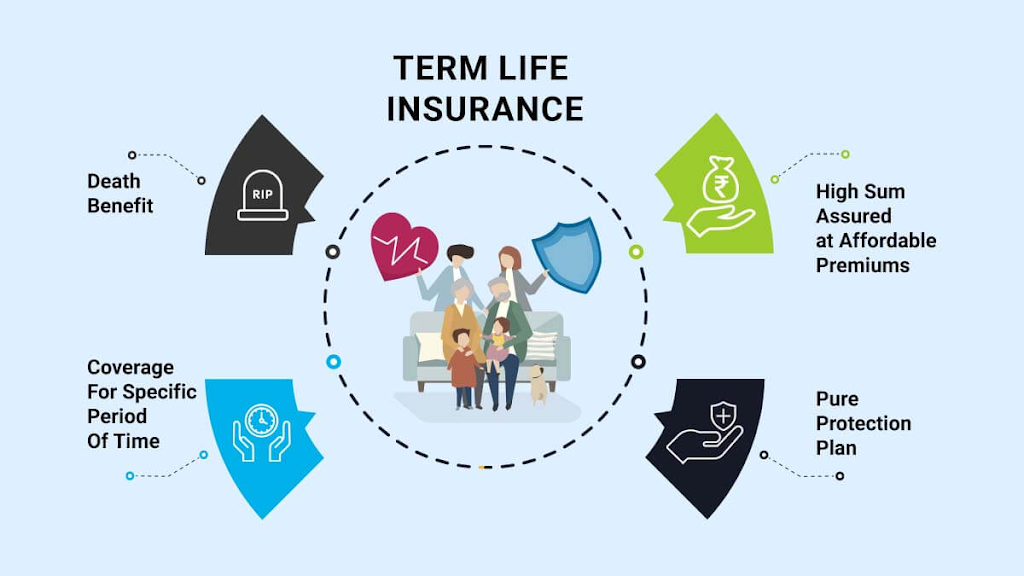

Term life insurance is a type of insurance policy that provides coverage for a specific period of time, typically ranging from 10 to 30 years. It is designed to provide financial protection for your loved ones in the event of your death. Term life insurance is an important investment for anyone who has dependents or financial obligations, as it can help ensure that your loved ones are taken care of financially after you’re gone.

In today’s digital age, the convenience and benefits of purchasing term life insurance online cannot be overstated. With just a few clicks, you can research, compare, and purchase policies from the comfort of your own home. Online platforms have made it easier than ever to find affordable term life insurance options that fit your specific needs and budget. In this article, we will explore the various advantages of purchasing term life insurance online and why it is a smart choice for individuals looking to protect their loved ones.

Convenience at your fingertips: The ease of purchasing term life insurance online

One of the biggest advantages of purchasing term life insurance online is the accessibility it provides. With online platforms, you have access to a wide range of insurance providers and policies at your fingertips. You can easily research different companies, compare their offerings, and read customer reviews to make an informed decision. This eliminates the need to visit multiple insurance agencies or spend hours on the phone with agents.

Furthermore, purchasing term life insurance online allows you to do so from the comfort of your own home. You no longer have to take time out of your busy schedule to meet with insurance agents in person. Instead, you can browse policies and complete applications at any time that is convenient for you. This flexibility is especially beneficial for individuals with busy lifestyles or those who prefer to handle their financial matters on their own terms.

Time-saving benefits: How buying term life insurance online can save you valuable time

In addition to convenience, purchasing term life insurance online can save you valuable time. The traditional process of buying life insurance often involves multiple meetings with insurance agents, filling out extensive paperwork, and waiting for approval. This can be a time-consuming and tedious process.

With online platforms, the process of purchasing term life insurance is streamlined and simplified. You can fill out applications online, submit necessary documents electronically, and receive instant quotes. This eliminates the need for lengthy paperwork and reduces the time it takes to get coverage. In some cases, you can even receive instant coverage upon approval of your online application.

Cost-effective options: Finding affordable term life insurance policies online

Affordability is a key factor when it comes to purchasing term life insurance. Online platforms offer a wide range of options that cater to different budgets and financial situations. By comparing prices from multiple insurance providers, you can easily find the best deal for your specific needs.

Online platforms also allow you to customize your policy to fit your budget. You can choose the coverage amount, term length, and additional riders that best suit your individual needs and financial goals. This level of customization ensures that you are only paying for the coverage you need, making term life insurance more affordable and cost-effective.

Comparing quotes made simple: The advantages of online platforms for comparing term life insurance quotes

Comparing quotes from different insurance providers is an essential step in finding the right term life insurance policy. Online platforms make this process simple and efficient. With just a few clicks, you can easily compare quotes from multiple insurance providers side by side.

This allows you to see the differences in coverage amounts, premiums, and policy terms, making it easier to make an informed decision. By comparing quotes online, you can ensure that you are getting the best value for your money and finding a policy that meets your specific needs.

Customization made easy: Tailoring your term life insurance policy to fit your specific needs

Every individual has unique financial needs and goals, and term life insurance should be tailored to fit those needs. Online platforms make it easy to customize your term life insurance policy to fit your specific needs and budget.

You can choose the coverage amount that provides adequate financial protection for your loved ones. You can also select the term length that aligns with your financial goals, whether it’s to cover a mortgage, pay for your children’s education, or provide income replacement for a certain number of years.

Additionally, online platforms offer a variety of additional riders that can be added to your policy for an extra cost. These riders provide additional benefits such as accelerated death benefit, critical illness coverage, or disability coverage. By customizing your policy online, you can ensure that you are getting the coverage that best suits your individual needs.

No-pressure decision-making: The freedom to research and choose the right term life insurance policy online

When purchasing term life insurance online, you have the freedom to research and make decisions at your own pace. There is no pressure from insurance agents to make a quick decision or sign up for a policy that may not be the best fit for you.

You can take the time to thoroughly research different insurance providers, read customer reviews, and compare policies before making a decision. This allows you to make an informed choice based on your own needs and preferences. The absence of sales pressure ensures that you are choosing a policy that truly meets your financial goals and provides adequate protection for your loved ones.

Access to expert advice: Online resources to help you make informed decisions about term life insurance

While purchasing term life insurance online gives you the freedom to make decisions on your own terms, it doesn’t mean you have to navigate the process alone. Online platforms often provide access to a wealth of resources to help you make informed decisions about term life insurance.

These resources may include articles, guides, and customer reviews that provide valuable insights into the different aspects of term life insurance. You can also seek advice from insurance experts through online chat or email support. This ensures that you have access to the information and guidance you need to make the best decision for your financial future.

Streamlined application process: The simplicity of applying for term life insurance online

Applying for term life insurance online is a simple and straightforward process. Online platforms have streamlined the application process, making it easier than ever to get coverage.

You can fill out applications online, providing all the necessary information and documentation electronically. This eliminates the need for extensive paperwork and reduces the chances of errors or delays in processing your application. Once your application is submitted, you can track its progress online and receive updates on its status.

Instant coverage: How buying term life insurance online can provide immediate protection for your loved ones

One of the biggest advantages of purchasing term life insurance online is the ability to receive instant coverage upon approval of your application. This means that as soon as your application is processed and approved, your loved ones are immediately protected financially in the event of your death.

This instant coverage provides peace of mind, knowing that your loved ones will be taken care of financially even if something were to happen to you. It ensures that they will have the financial resources they need to cover expenses such as mortgage payments, education costs, and daily living expenses.

Future-proofing your finances: The long-term financial benefits of purchasing term life insurance online

Purchasing term life insurance online not only provides immediate protection for your loved ones but also offers long-term financial benefits. By having a term life insurance policy in place, you are future-proofing your finances and ensuring that your loved ones are financially secure even after you’re gone.

Term life insurance can help cover expenses such as mortgage payments, outstanding debts, funeral costs, and daily living expenses. It can also provide income replacement for your loved ones, ensuring that they can maintain their standard of living and meet their financial obligations.

Managing your term life insurance policy online is also convenient and easy. You can make premium payments, update beneficiaries, and access policy information at any time through the online platform. This ensures that your policy remains up to date and aligned with your changing financial needs.

Conclusion

Purchasing term life insurance online offers a wide range of convenience and benefits. From the accessibility and ease of researching and comparing policies to the time-saving benefits of not having to meet with insurance agents in person, buying term life insurance online is a smart choice for individuals looking to protect their loved ones.

The cost-effective options, ability to compare quotes, and customization options available online make it easier than ever to find a policy that fits your specific needs and budget. The freedom to research and make decisions at your own pace, along with access to expert advice through online resources, ensures that you are making an informed decision about your financial future.

The streamlined application process and instant coverage provided by purchasing term life insurance online offer peace of mind, knowing that your loved ones will be protected financially in the event of your death. Furthermore, the long-term financial benefits of term life insurance, such as providing financial security for your loved ones and protecting your assets, make it a valuable investment for anyone with dependents or financial obligations.

In conclusion, take advantage of the accessibility and simplicity of online platforms for your term life insurance needs. By doing so, you can ensure that your loved ones are protected financially and have the resources they need to maintain their standard of living even after you’re gone.